Roth ira earnings calculator

Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments. For 2022 the maximum annual IRA.

Roth Ira Calculator How Much Could My Roth Ira Be Worth

This tool is intended to show the tax treatment of distributions from a Roth IRA.

. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. That is it will show which amounts will be subject to ordinary income tax andor 10 penalty Please note. New Look At Your Financial Strategy.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. This calculator assumes that you make your contribution at the beginning of each year. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing a separate return and you lived with. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. For the purposes of this.

The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. The Standard Poors 500 SP.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. When you invest 500 and earn a 10 annual return your balance grows by 50 to 550 after the first year. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA.

You can adjust that contribution. Ad Learn About Tax Advantages And Contribution Limits. Open a Roth IRA Account.

Get Up To 600 When Funding A New IRA. Then in the next year assuming you get the. A 401 k can be an effective retirement tool.

Explore Choices For Your IRA Now. You can print the results for future reference. For 2022 the maximum annual IRA.

Build Your Future With a Firm that has 85 Years of Retirement Experience. Traditional IRA Calculator can help you decide. There are two basic types of individual retirement accounts IRAs.

Heres how it works. The actual rate of return is largely dependent on the types of investments you select. Ad Get Up To 600 When Funding A New IRA.

The Sooner You Invest the More Opportunity Your Money Has To Grow. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. The amount you will contribute to your Roth IRA each year.

Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. While long-term savings in a.

The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions. Traditional IRA Calculator Calculate your earnings and more An IRA can be an effective retirement tool. Ad Open an IRA Explore Roth vs.

The amount you will contribute to your Roth IRA each year. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. This limit applies across all IRAs.

Traditional or Rollover Your 401k Today. Traditional IRA depends on your income level and financial goals. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target.

Married filing jointly or head of household. Choosing between a Roth vs. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. The Roth 401 k allows contributions to. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Keep Your Retirement On Track. Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. For comparison purposes Roth IRA.

The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of each year. Explore Your Choices For Your IRA.

129000 for all other individuals. Visit The Official Edward Jones Site. Calculate your earnings and more.

The calculator will estimate the monthly payout from your Roth IRA in retirement. This calculator assumes that your return is compounded annually. This calculator assumes that you make your contribution at the beginning of each year.

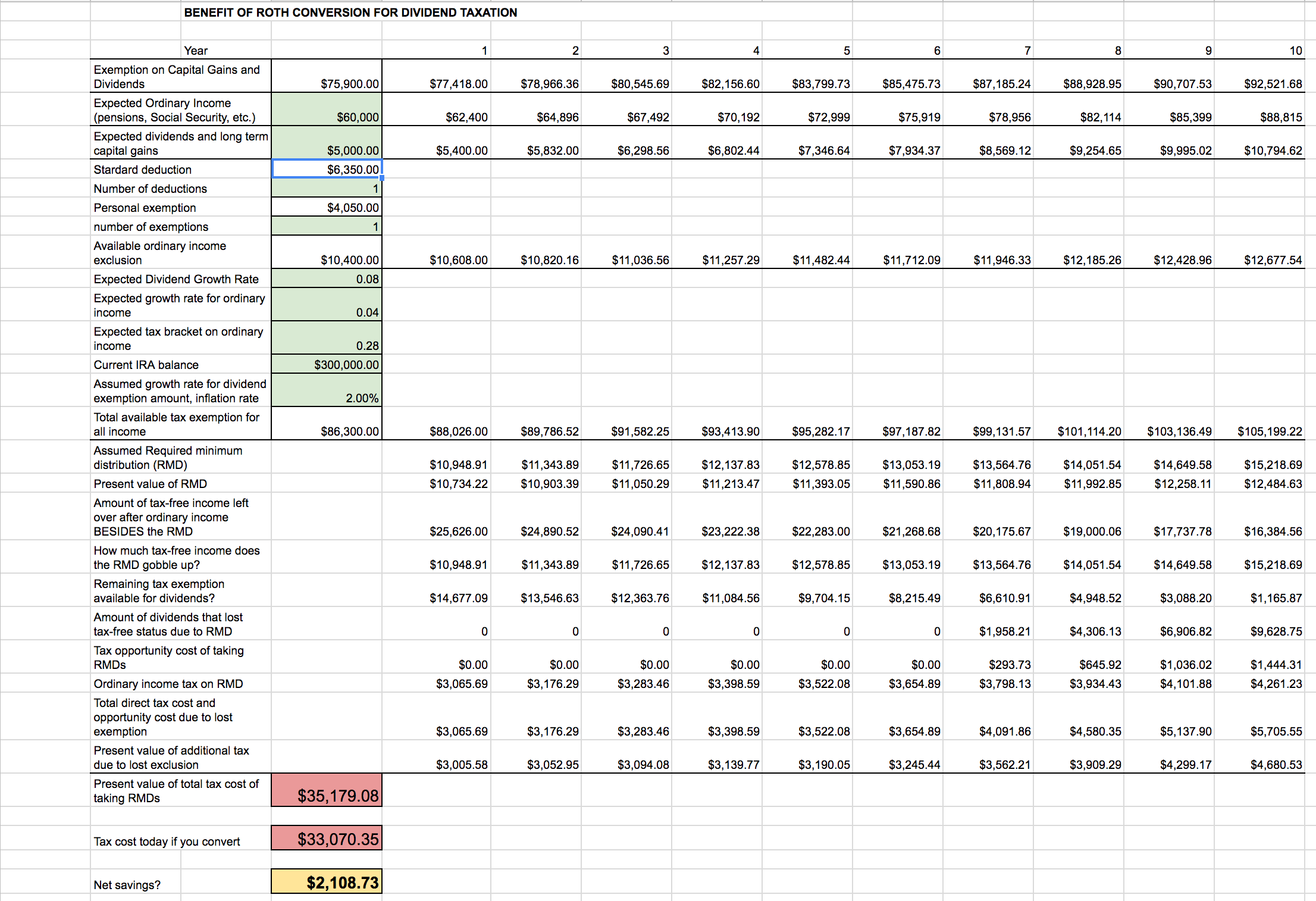

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

The Ultimate Interactive Roth Ira Calculator Blog

Roth Ira Savings And Earning Calculator

Strata Trust Company Twitterren Use This Roth Ira Calculator To Compare The Roth Ira To An Ordinary Taxable Investment Https T Co Zkaxyfaumr Retirementplanning Https T Co 5hzwv5jvbl Twitter

Roth Ira Conversion Tax Calculator Software

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Calculator Roth Ira Contribution

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Excel Template For Free

Traditional To Roth Ira Conversion Calculator Keep Or Convert